Understanding Portfolio and Position Drawdowns in the Crypto Market: Risk Management Metrics

Author

CoinIQ

Date Published

In the fast-paced world of cryptocurrency investing, the term “drawdown” frequently surfaces in conversations among traders and investors alike. Whether you’re a seasoned crypto enthusiast or a newcomer trying to navigate the volatile market, understanding both portfolio and position drawdowns is crucial to managing risk and ensuring long-term success. In this blog, we’ll break down what drawdowns are, how they differ in crypto versus other asset classes, why you should be wary of them, and how using a portfolio management tool can be a game changer in gauging your risk exposure.

What Are Drawdowns?

Drawdown is a financial term that describes the decline from a peak to a trough in the value of an investment or portfolio. There are two primary types:

- Portfolio Drawdown: This refers to the overall reduction in the value of your entire investment portfolio. It takes into account the performance of all your holdings combined.

- Position Drawdown: This focuses on the loss experienced on a single asset or position. For instance, if you invest in Bitcoin and its price drops significantly from your purchase point, the loss on that particular position is its drawdown.

These concepts are not unique to crypto but are especially pertinent in this space due to the inherent volatility. With cryptocurrencies, sharp price swings can lead to severe drawdowns in a very short time, making it vital to have a robust risk management strategy in place.

The Crypto Market: A Breeding Ground for Drawdowns

The Nature of Crypto Volatility

Cryptocurrencies are known for their dramatic price movements. Factors such as market sentiment, regulatory developments, technological advancements, and even tweets from influential figures can result in rapid price swings. For example, Bitcoin, the flagship cryptocurrency, has experienced drawdowns exceeding 80% during its most turbulent periods. In 2018, Bitcoin’s price dropped dramatically from its all-time high, showcasing the intense volatility that defines the crypto market.

Historical Drawdown Statistics

A glance at historical data reveals some staggering figures:

- Bitcoin: Historically, Bitcoin has seen drawdowns of 70% to over 80% during significant market corrections. This level of volatility is far beyond what many traditional asset classes experience.

- Altcoins: Many alternative cryptocurrencies, or altcoins, can experience even sharper drawdowns. Smaller market cap coins might see drawdowns of 90% or more, especially during market downturns.

- Portfolio Implications: For crypto portfolios that include a mix of these volatile assets, the overall drawdown can be severe unless risk is managed effectively.

The high drawdown potential in crypto is both an opportunity and a warning. While massive price swings can lead to substantial gains during bullish runs, they also expose investors to significant losses during market downturns.

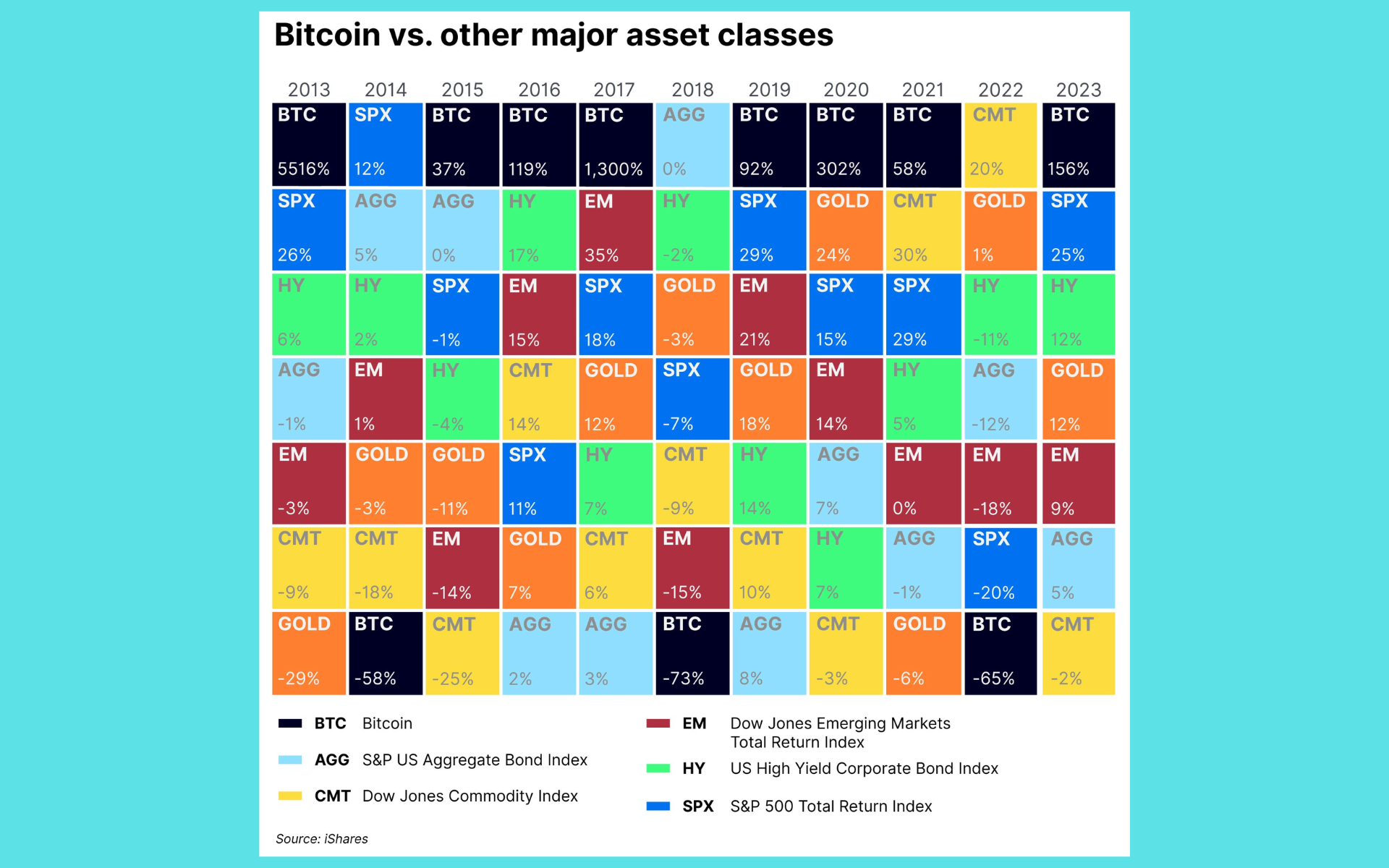

Comparing Crypto Drawdowns to Other Asset Classes

To put crypto drawdowns into perspective, it’s useful to compare them with those observed in traditional asset classes such as stocks, bonds, and real estate.

Stocks

- Market Behavior: The stock market, especially large-cap stocks like those in the S&P 500, tends to be less volatile than the crypto market. Even during major economic downturns like the 2008 financial crisis, drawdowns were severe (often in the range of 40-60%), but they generally did not reach the extremes seen in crypto.

- Risk Management: Investors in equities have access to various risk management tools like stop-loss orders, dividend reinvestment plans, and diversification strategies. Moreover, market regulators and established financial institutions help create a relatively stable environment.

- Drawdown Duration: Historically, stock market drawdowns can last for months to years. However, recovery periods are typically supported by economic fundamentals and government intervention.

Bonds

- Market Behavior: Bonds, especially high-quality government bonds, are typically considered a safe haven in turbulent times. Drawdowns in bond markets are usually much smaller compared to stocks and crypto, often hovering around single digits.

- Stability: Because of their fixed-income nature, bonds provide more predictable returns. Investors are drawn to bonds for portfolio diversification and capital preservation.

- Risk Factors: Although bonds are less volatile, risks still exist—particularly with corporate or high-yield bonds that can experience larger drawdowns during economic downturns.

Real Estate

- Market Behavior: Real estate investments tend to be less liquid and more stable over the long term. Drawdowns in the real estate market are generally moderate, influenced by local economic conditions and market cycles.

- Tangible Asset: Unlike crypto or stocks, real estate is a tangible asset. This can sometimes make investors more patient during downturns, even if property values decline.

- Drawdown Potential: During a severe recession, real estate values can drop, but such scenarios are typically less dramatic compared to the wild swings in the crypto market.

Key Comparisons

- Magnitude: Crypto drawdowns are often more extreme than those seen in stocks, bonds, or real estate.

- Frequency: The crypto market experiences more frequent and rapid drawdowns due to its 24/7 trading environment and susceptibility to market sentiment.

- Recovery Speed: While some traditional assets may take years to recover from drawdowns, crypto assets can rebound more quickly during bull markets, albeit with the risk of recurring volatility.

Understanding these differences is essential for investors. By comparing crypto drawdowns to those in other asset classes, one can better appreciate the unique risks—and potential rewards—associated with the cryptocurrency market.

Why You Should Be Wary of Drawdowns

The Psychological Impact

One of the most underestimated aspects of drawdowns is their psychological impact. Investors often experience fear, anxiety, and doubt when their portfolios take a significant hit. This emotional response can lead to impulsive decisions such as panic selling, which may result in locking in losses rather than riding out the volatility for a potential recovery.

Financial Consequences

- Capital Erosion: A large drawdown can quickly erode your capital. For example, a 50% drawdown means that your investment must double in value just to break even.

- Margin Calls and Leverage: In crypto trading, many investors use leverage to amplify gains. However, this also increases risk, as even a small market move can trigger margin calls and force the liquidation of positions.

- Liquidity Risks: During severe drawdowns, liquidity can dry up. This makes it challenging to exit positions without incurring further losses, which is especially problematic in markets that are not as deep as traditional asset classes.

The Ripple Effect on Your Portfolio

A significant position drawdown can have a domino effect on your overall portfolio. If one asset experiences a drastic decline, it can offset gains in other areas, skewing your asset allocation and overall risk profile. This imbalance can reduce your portfolio’s resilience against future market shocks.

Statistical Backing

- Crypto’s Extreme Volatility: Studies have shown that the standard deviation of crypto returns is much higher than that of traditional assets. For instance, while the average annualized volatility of the S&P 500 hovers around 15%, Bitcoin’s volatility can easily exceed 80% during turbulent periods.

- Correlation Factors: During market downturns, correlations between crypto assets and other asset classes can spike, meaning that diversification benefits might diminish just when you need them most.

Assessing Your Drawdown Tolerance

Know Your Risk Appetite

Determining how much of a drawdown you can tolerate is a deeply personal decision and depends on your investment goals, time horizon, and financial situation. Here are some key factors to consider:

- Investment Horizon: If you’re investing for the long term, you might be able to tolerate deeper drawdowns, knowing that markets can recover over time. Short-term investors, on the other hand, may need to be more cautious.

- Financial Cushion: Ensure that you have enough liquidity or an emergency fund to avoid being forced to liquidate positions during a downturn.

- Emotional Resilience: Ask yourself how you’ve reacted to market downturns in the past. If past volatility has made you anxious, you might need to adjust your asset allocation or invest in less volatile assets.

Practical Steps to Gauge Tolerance

- Simulate Drawdowns: Some portfolio management tools allow you to simulate various drawdown scenarios. By stress-testing your portfolio, you can see how different levels of losses would impact your overall wealth.

- Set Stop-Loss Orders: While not foolproof, stop-loss orders can help manage risk by automatically selling assets when they drop to a predetermined level. However, in highly volatile markets like crypto, they can sometimes trigger sales at unfavorable prices.

- Regular Portfolio Reviews: Regularly reviewing your portfolio can help you adjust your strategies based on current market conditions and your evolving risk tolerance.

By honestly assessing your risk tolerance, you can develop a strategy that aligns with your financial goals and minimizes the likelihood of panic-induced decisions during volatile periods.

The Role of Portfolio Management Tools

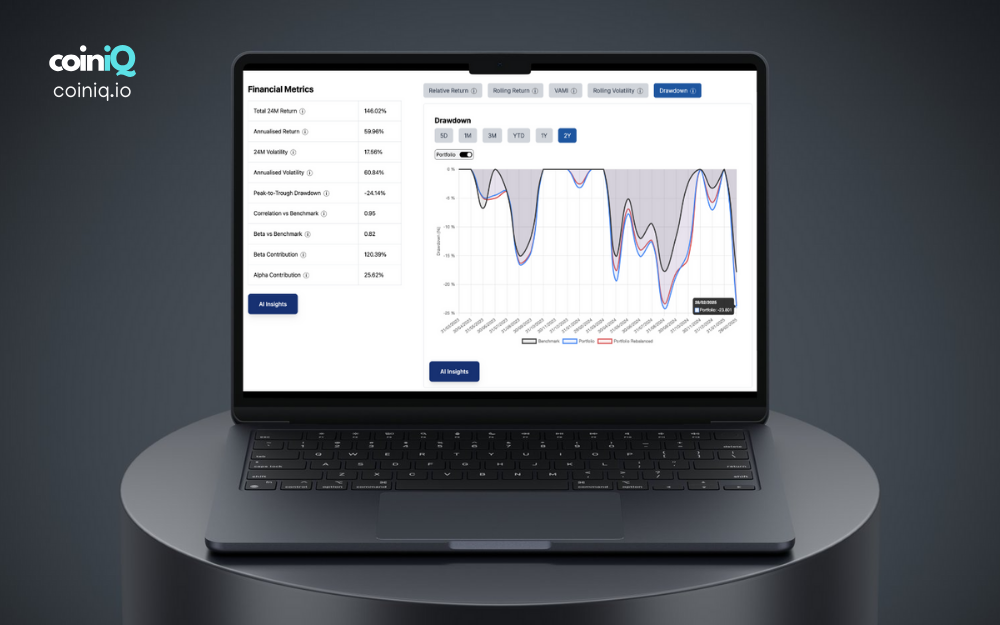

Given the complexity and volatility of the crypto market, having a robust portfolio management tool like CoinIQ is indispensable. Here’s why:

Real-Time Monitoring and Analysis

- Comprehensive Data: Good portfolio management tools aggregate data from various sources, providing a real-time snapshot of your portfolio’s performance. This includes tracking individual asset drawdowns as well as overall portfolio performance.

- Automated Alerts: Many tools offer customizable alerts that notify you when certain thresholds are met. For example, you can set alerts for when a position drawdown exceeds a specific percentage, allowing you to act quickly.

- Historical Analytics: By reviewing past drawdown events, these tools can help you identify patterns and potential vulnerabilities in your portfolio. This historical perspective is crucial for making informed decisions.

Enhanced Decision-Making

- Risk Metrics: Advanced tools calculate key risk metrics such as Value at Risk (VaR) and Conditional Value at Risk (CVaR), offering deeper insights into potential future losses. Understanding these metrics can help you better prepare for market downturns.

- Scenario Analysis: Portfolio management software often includes scenario analysis features that allow you to model the impact of various market conditions on your investments. This proactive approach can be particularly beneficial in a market as unpredictable as crypto.

- Portfolio Diversification Insights: These tools can highlight whether your portfolio is overly concentrated in volatile assets, prompting you to consider diversification strategies that can reduce overall risk.

Why Drawdown Awareness Is Critical

The Risks of Underestimating Drawdowns

- Financial Health: A severe drawdown can compromise your financial goals by significantly reducing your capital base. For instance, if you experience a drawdown that wipes out 50% of your portfolio, you would need a 100% gain just to return to your original value.

- Emotional Turbulence: The stress of watching your investments plummet can lead to irrational decisions such as panic selling or chasing losses, which may worsen your financial situation.

- Opportunity Cost: Being overly cautious or overly aggressive in response to drawdowns can lead to missed opportunities. Knowing your risk tolerance can help you avoid reactionary moves that could hinder long-term growth.

Tools and Strategies to Mitigate Impact

- Stop-Loss and Take-Profit Orders: These can help lock in gains and limit losses, though they require careful management in volatile markets.

- Rebalancing: Regularly rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment objectives.

- Hedging Strategies: Some investors turn to hedging strategies, such as using options or futures, to protect against extreme drawdowns. However, these require a deep understanding of the instruments and the associated risks.

- Portfolio Management Tools: There are tools that provide insights on your portfolio's drawdown potential by assessing the risks (and volatility--yes, they are different!) of your holdings. We believe the outstanding tool is of course, CoinIQ, given the breadth and depth of its return and volatility calculations.

Being proactive about drawdown management means acknowledging that volatility is inherent in crypto markets and planning accordingly. The more prepared you are, the less likely you are to be caught off guard by sudden market downturns.

Building a Resilient Investment Strategy

Developing a Long-Term Mindset

While it’s tempting to react to every market move, successful investing—especially in crypto—demands a long-term perspective. Accept that drawdowns are part of the journey and that recovery often follows periods of significant loss. This mindset can help you stay focused on your long-term financial goals rather than getting bogged down by short-term market fluctuations.

Establishing Clear Investment Goals

Before you even start investing, define what you hope to achieve:

- Financial Goals: Are you saving for retirement, a major purchase, or simply looking to grow your wealth?

- Risk Tolerance: How much loss can you afford to withstand without jeopardizing your financial stability?

- Time Horizon: Longer investment horizons typically allow for greater tolerance of drawdowns, as there is more time for markets to recover.

Clear goals help inform your asset allocation decisions, ensuring that your portfolio aligns with your risk tolerance. For example, if you are risk-averse, you might limit your exposure to high-volatility assets like cryptocurrencies and invest more heavily in bonds or dividend-paying stocks.

Educational Investment

Knowledge is power in the world of investing. By continuously educating yourself about market trends, historical drawdown statistics, and risk management strategies, you can make more informed decisions. Subscribing to reputable financial publications, following expert commentary, and even participating in investment forums can provide valuable insights into navigating volatile markets.

Conclusion: Navigating the Crypto Rollercoaster

Investing in the crypto market is not for the faint-hearted. The extreme volatility that makes cryptocurrencies so alluring also brings significant risks in the form of portfolio and position drawdowns. Understanding these drawdowns, comparing them to other asset classes, and honestly assessing your own risk tolerance are critical steps toward long-term success in this space.

To summarise:

- Drawdowns Defined: A drawdown represents the decline from a peak to a trough, affecting both individual positions and overall portfolio value.

- Crypto vs. Traditional Assets: Crypto drawdowns tend to be more extreme and frequent compared to stocks, bonds, and real estate, requiring a unique risk management approach.

- The Human Factor: Emotional reactions to drawdowns can lead to costly mistakes; a clear, long-term strategy is key.

- Risk Tolerance and Mitigation: Regular portfolio reviews, stop-loss orders, and diversification are fundamental in managing drawdown risk.

- Empowerment Through Technology: Portfolio management tools, such as (and especially) CoinIQ, offer real-time analytics, and advanced risk (and performance) metrics that are essential for navigating a volatile market.

In a world where market conditions can shift dramatically within hours, using a portfolio management tool isn’t just a convenience—it’s a necessity. These tools help you stay informed, manage risk proactively, and ultimately, preserve and grow your wealth even in the face of significant drawdowns. Embracing technology in your investment strategy allows you to make data-driven decisions, align your portfolio with your risk tolerance, and remain calm during market turbulence.

Remember, while crypto can offer exponential gains, it also demands respect for its inherent risks. By taking the time to understand drawdowns, comparing the crypto landscape to other asset classes, and actively managing your portfolio, you can navigate this exciting yet unpredictable market with confidence.

Stay educated, remain vigilant, and leverage the best tools available. In doing so, you not only protect your investments but also set the stage for long-term financial success in an ever-evolving market environment.

Find out why crypto investors need portfolio management tools to track performance, manage risk, and make data-driven investment decisions.