+3,000 coins

Insights in 1 minute

Maximize long-term growth

Smarter Crypto Investing Starts Here

Turn crypto chaos into clarity with intelligent analytics for serious investors

Covering over 3,000 coins, connect your wallets and get detailed insights in under a minute.

Built on trusted data from the industry's most reliable sources

Smarter insights built around you.

From your trading style to your comfort with risk, CoinIQ's AI turns your preferences into smarter, data-backed suggestions.

Every Insight, One Platform

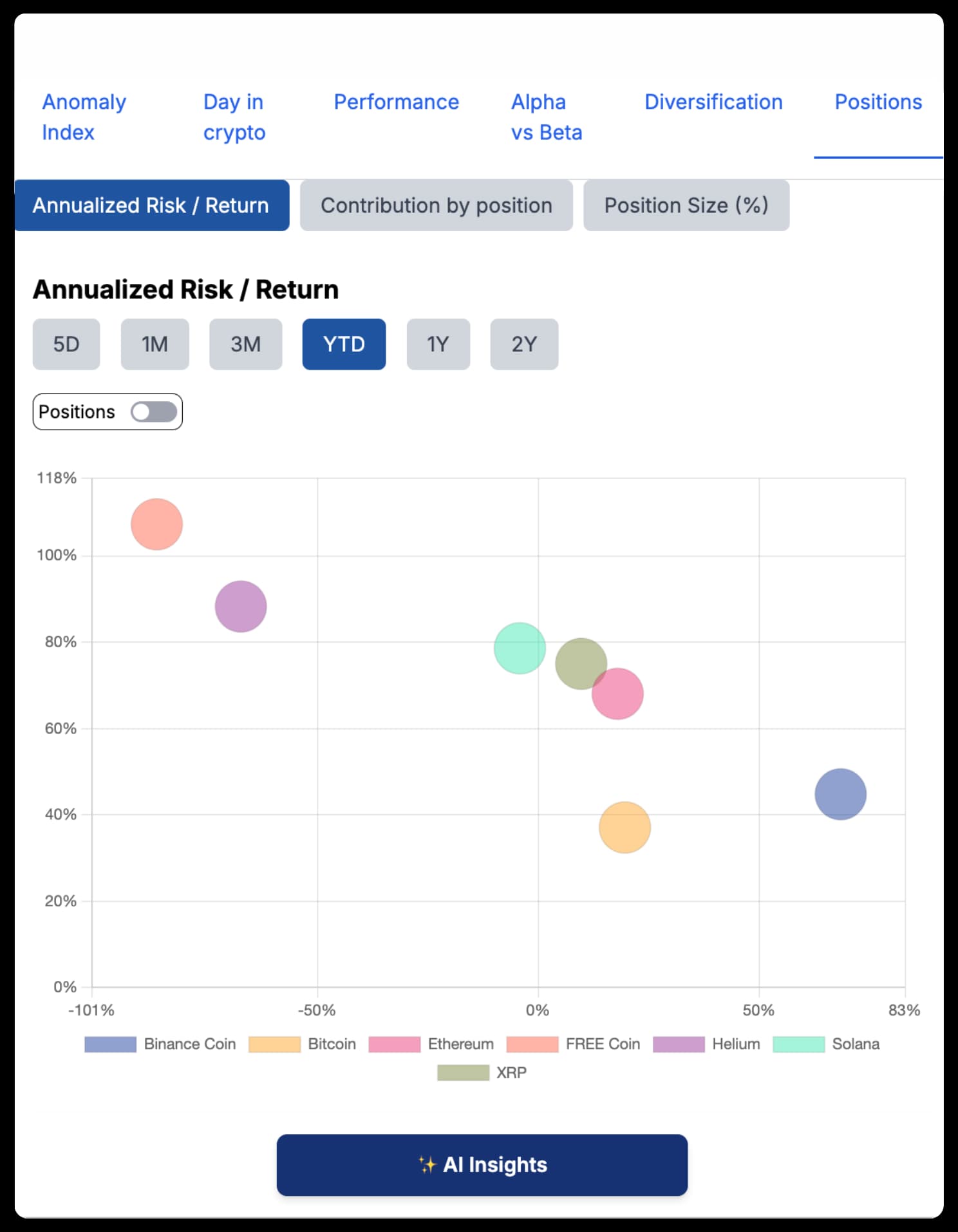

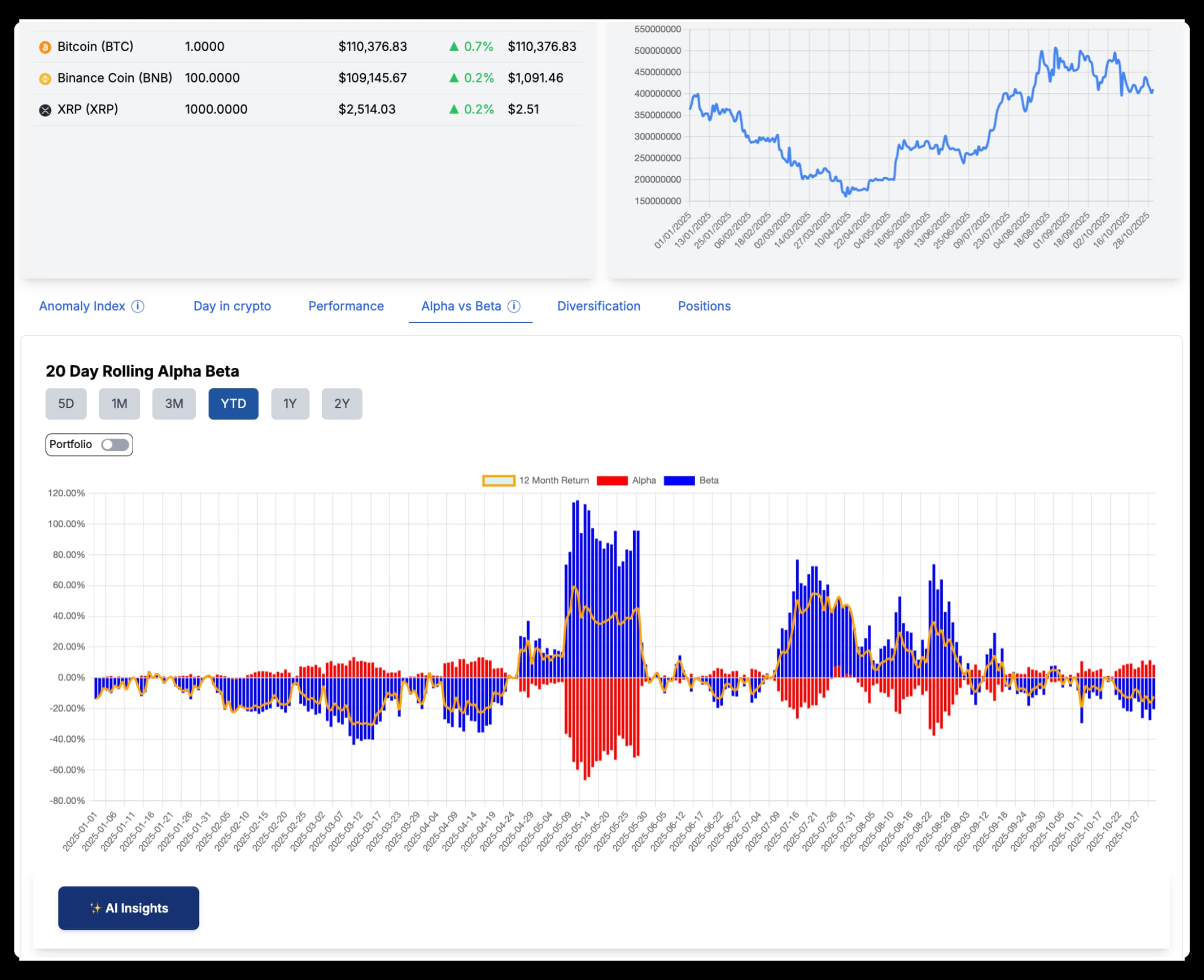

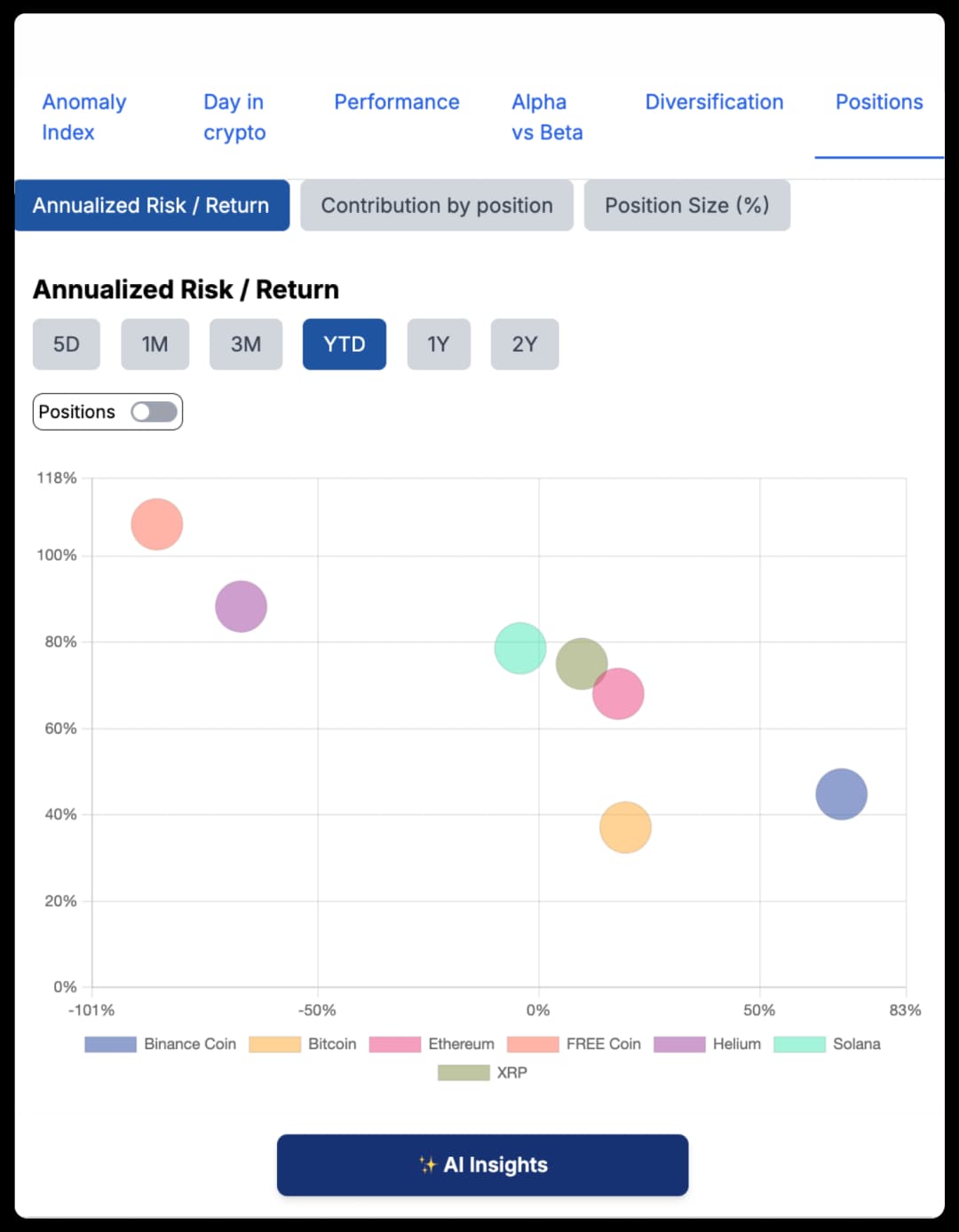

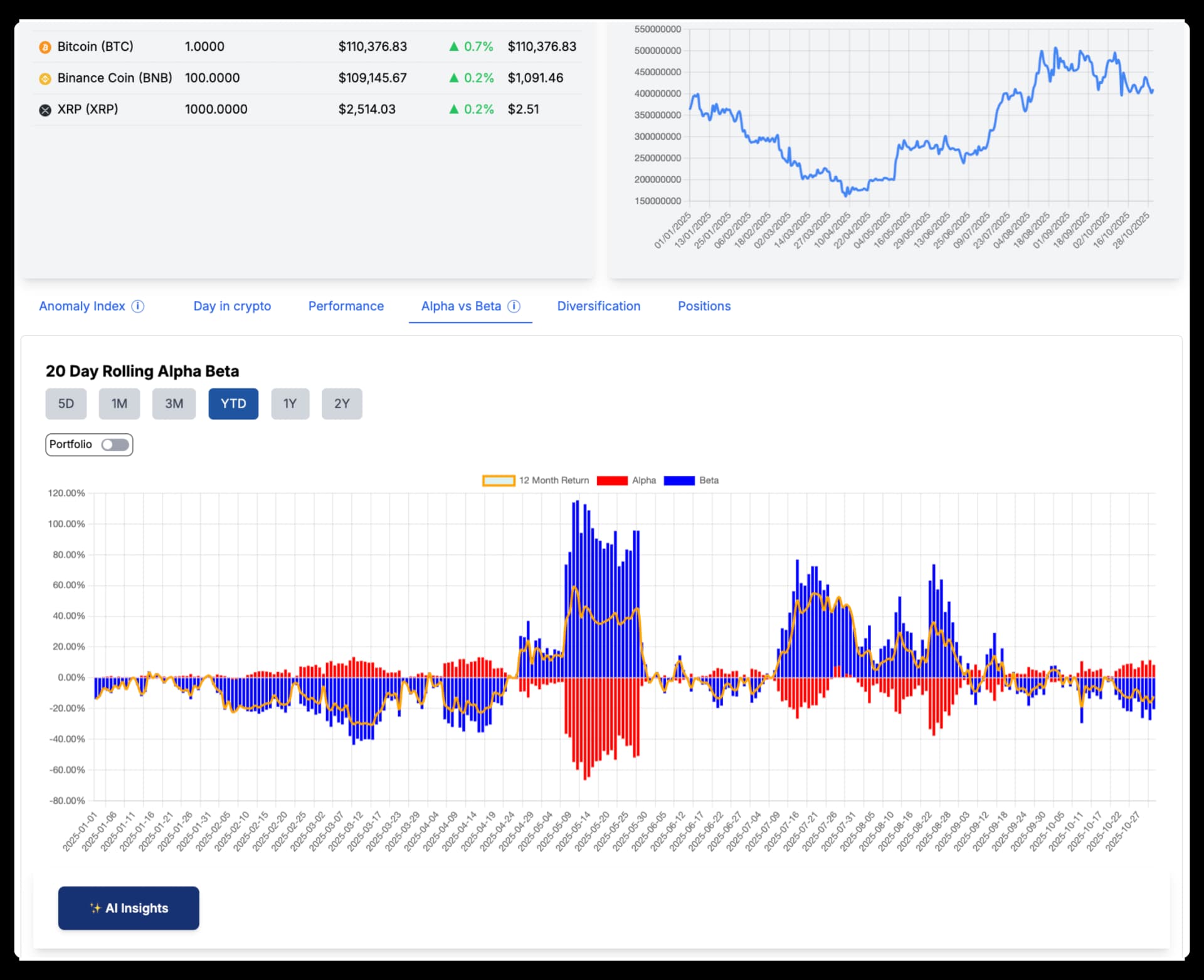

Analyze performance, detect anomalies, stay informed, and trade instantly, all in one intelligent dashboard

Master Your Portfolio in Minutes

Analyze, optimise, and trade, all in one place.

Recognized and trusted by users worldwide

5,0

Product hunt

5,0

G2 review

As someone juggling multiple wallets, the unified portfolio view is a game-changer. I can see everything clearly and act faster.

Victoria D.

CoinIQ finally makes sense of my crypto chaos AI‑powered intel, unified wallets, and smart alerts all in one sleek dashboard.

Bhavya Arora

CoinIQ helped me finally make sense of my crypto portfolio. The Diversification analysis and Ai insights made it clear that I need to rebalance before a major dip.

Rae Wee

Been playing around with this and it’s refreshingly straightforward. Instead of just telling me I’m down 12%, it explains why and suggests what I might do about it. The AI spots weird activity, gives quick portfolio summaries, and breaks down performance without drowning me in jargon. Having swaps and conversions right there saves me from bouncing between tabs. Feels a bit like Bloomberg for crypto, but without the intensity. Curious to see how it develops.

Harry M.

As someone who’s still pretty new to crypto, most tools I’ve tried just throw charts and numbers at me with no explanation. CoinIQ is the first platform I’ve used that actually helps me understand what’s going on in my portfolio. The AI insights are super helpful, especially when it flags weird activity or market moves I wouldn’t have noticed on my own. I also like the on-chain news summaries, it saves me from having to Google every little thing. Still figuring things out, but CoinIQ already makes me feel way more confident navigating this space. Excited to see how it evolves!

Anastasia C.

I've tried some of the alternatives in the past (Coinstats, Coingecko etc.) but they're all just trackers, letting me know how much I've made/lost on each position. This however feels like having a brutally honest, market-obsessed friend who watches my crypto 24/7 and isn’t afraid to tell me where I’m messing up. Having the ability to see my portfolio-level data with all my portfolios/wallets holistically is an absolute game changer.

Sam Avest

FAQs

Get answers to the most common questions about CoinIQ.

CoinIQ is a crypto portfolio analytics platform that helps you properly understand what’s going on inside your portfolio, beyond just price. We use smart data and AI to break down performance, risk, and positioning across all your holdings, so you can make better decisions with confidence.

Most crypto apps stop at tracking prices and balances. CoinIQ goes several steps further: we analyze your portfolio’s returns, volatility, correlation, drawdowns, and more. Plus, we add AI-generated insights to help you spot what’s working, what’s dragging you down, and what to watch.

Nope, not if you don’t want to. You can import your portfolio manually if you prefer. But if you’d like real-time syncing, you can connect your wallet or exchange account securely via read-only access.

Absolutely. We don’t ask for private keys or trading access. Any integrations use encrypted, read-only connections. Your data is handled with care, and we never sell or share it.

Whether you’re just getting started or you’ve been trading since the ICO boom, CoinIQ is designed to support every kind of crypto investor, from ‘Bitcoin Maximalists’ to ‘High-Risk Momentum Traders’. Our onboarding questions help personalize your experience based on your goals and risk profile.

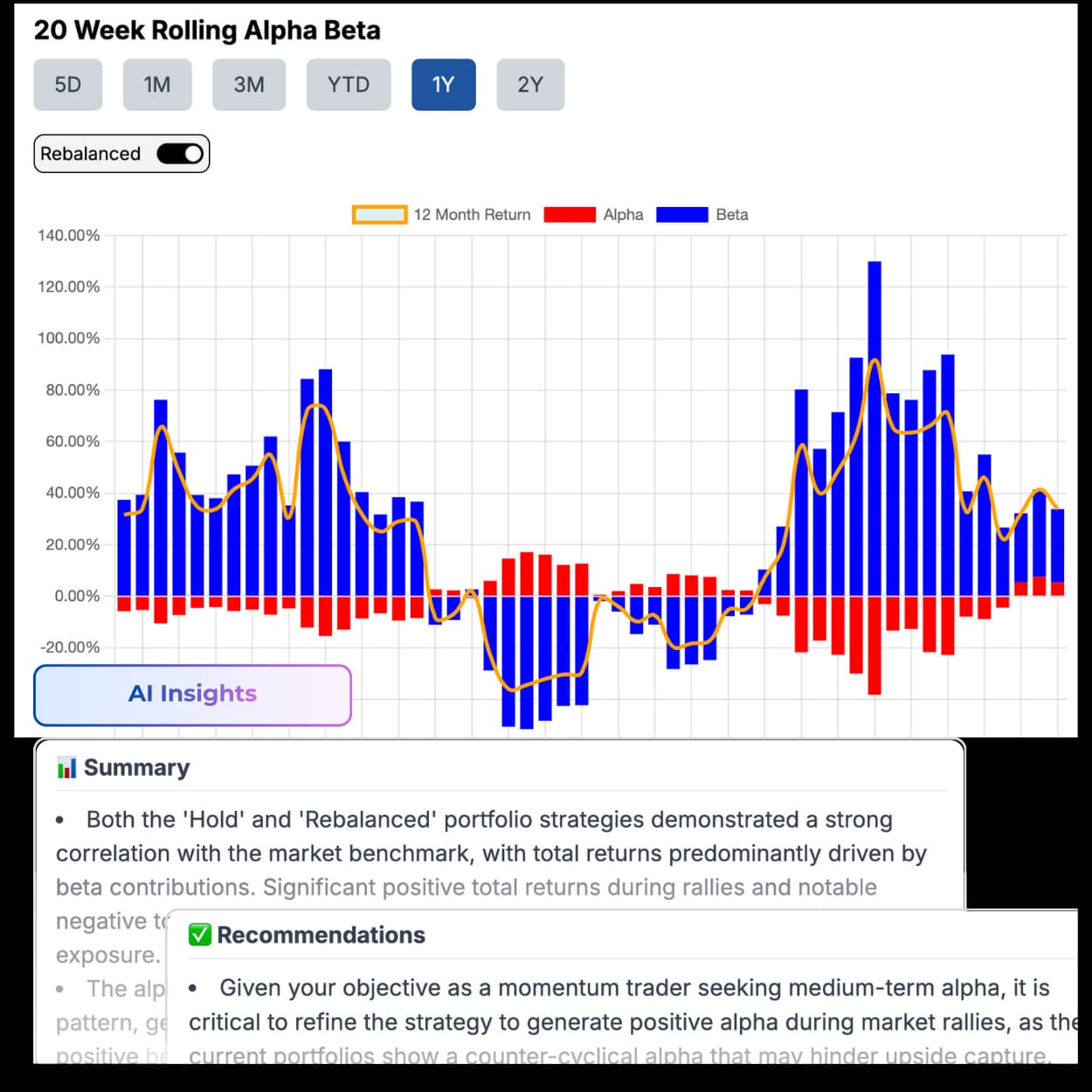

We break it all down for you: return analysis (compounded, rolling, and relative), volatility trends, and overall risk levels. You’ll see how your portfolio stacks up with alpha and beta performance compared to the market, and how your assets move together through correlation metrics. We also run liquidity checks to flag thin or risky tokens and apply scam risk scores powered by our in-house models. Plus, we provide allocation and contribution breakdowns so you know exactly what’s driving your performance. And that’s just the start, everything is explained in plain English, no PhD required.