Why Portfolio Management Tools Are Essential in Crypto Investing

Author

CoinIQ

Date Published

The crypto market is notorious for its volatility. One minute, Bitcoin is soaring to new all-time highs, and the next, a sudden downturn wipes out billions in market value. While seasoned investors are aware of the risks, many newcomers—lured by the prospect of quick gains—fail to fully grasp the complexities of managing a crypto portfolio effectively.

The Underestimated Risks of Crypto Investing

A vast majority of investors enter the crypto space without a proper risk management strategy. Unlike traditional financial markets, which have decades of regulatory frameworks and stability, crypto remains highly unpredictable.

Compared to equities, bonds, or even commodities, crypto markets experience significantly higher levels of volatility. While stock markets may see daily swings of 1-2%, crypto assets can easily move 10-20% or more in a single day. This heightened risk makes proper portfolio management even more crucial, as investors need to ensure they aren’t overexposed to extreme downturns or sudden price corrections. The lack of understanding around risks such as price swings, regulatory changes, security breaches, and liquidity issues often leads to poor investment decisions. Without proper tools to assess these risks, investors are flying blind in one of the most volatile asset classes in existence.

The Importance of Risk Awareness and Portfolio Assessment

To make informed investment decisions, crypto investors must consider various metrics that provide deeper insights into their portfolio. These include:

- Volatility Measures – Understanding the price fluctuations of individual assets and the overall portfolio.

- Correlation Analysis – Assessing how different assets within a portfolio move in relation to one another.

- Liquidity Metrics – Determining the ease of buying or selling assets without causing significant price impact.

- On-Chain Metrics – Analysing network activity, holder distribution, and transaction volumes.

- Drawdown Analysis – Measuring the potential loss from peak to trough to gauge downside risk.

- Return & Performance Metrics – Tracking total returns, risk-adjusted returns, and historical performance trends.

- Sentiment Metrics – Gauging market sentiment using social media trends, news analysis, and community engagement.

- ESG Metrics – Evaluating sustainability and ethical considerations within crypto investments, such as energy consumption and decentralisation principles.

By using these metrics, investors can build a clearer picture of the strengths and weaknesses in their portfolio and make more informed decisions accordingly.

Aligning Your Portfolio With Your Risk Tolerance & Return Objectives

Not all investors have the same appetite for risk. Some are comfortable with high-risk, high-reward strategies, while others seek stability and steady returns. A well-structured portfolio should reflect an investor's individual risk tolerance and long-term objectives.

To gauge risk tolerance, investors can use methods such as:

- Risk Profiling Questionnaires – These assess an investor’s comfort level with losses and fluctuations.

- Historical Stress Tests – Simulating past market crashes to see how a portfolio would have performed.

- Sharpe Ratio & Other Risk-Adjusted Return Metrics – Measuring whether the returns justify the level of risk taken.

- Scenario Analysis – Projecting how different market conditions would impact returns.

Once an investor understands their risk tolerance, they can align their portfolio accordingly—whether through diversifying across multiple asset classes, allocating more stablecoins to reduce volatility, or leveraging derivatives for risk management. The key is balancing risk exposure with expected returns to achieve an optimal investment strategy.

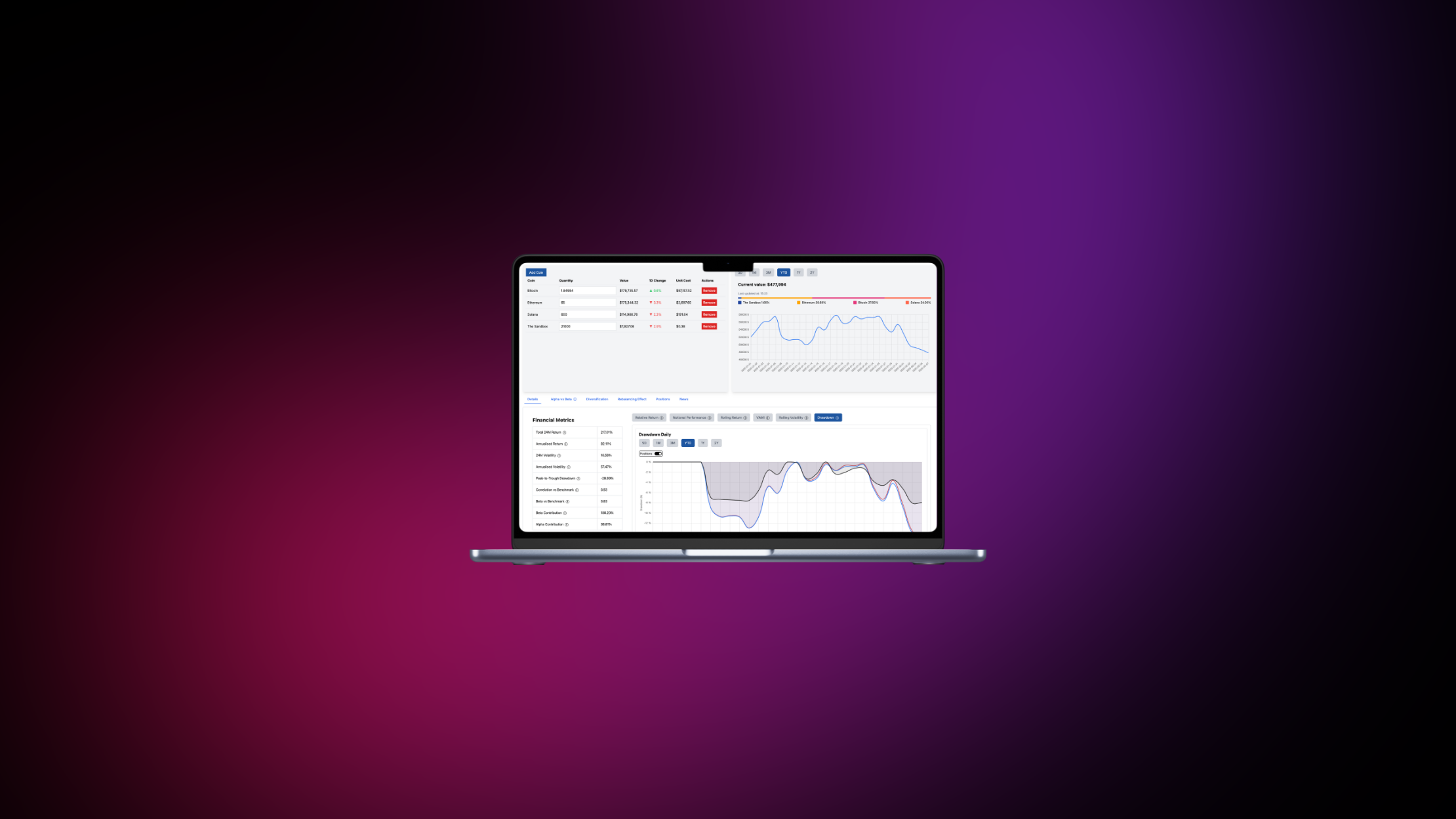

Why CoinIQ Stands Out

Most existing platforms fall into one of two categories:

- Basic Portfolio Trackers – These platforms allow users to monitor holdings but provide little in terms of risk assessment or portfolio optimisation.

- Market Insight Providers – They offer valuable data on price movements and market trends but lack portfolio management capabilities.

CoinIQ aims to bridge this gap by combining portfolio intelligence with deep market insights, enabling users to manage their investments optimally. Unlike traditional trackers, CoinIQ goes beyond basic performance metrics, providing a comprehensive analysis of risk factors, diversification strategies, and actionable insights tailored to individual investors.

Some of CoinIQ’s additional advantages include:

- Unified Portfolio & Wallet Integration – Manage multiple wallets and exchange accounts in one place, giving a seamless overview of your assets.

- Real-Time Risk Assessments – Identify weaknesses in your portfolio before they become major problems.

- Advanced Market Insights – Stay ahead of the curve with in-depth analysis of macro trends, on-chain data, and sentiment indicators.

- Customisable Alerts & Recommendations – Receive tailored insights based on your investment style and risk profile.

- Intelligent Rebalancing Tools – Adjust portfolio allocations dynamically to maintain optimal exposure.

With CoinIQ, users can:

- Assess real-time risks and optimise portfolio allocation.

- Gain smarter market insights to anticipate trends.

- Construct a portfolio that aligns with both their risk appetite and return objectives.

Final Thoughts

In a space as volatile as crypto, having the right tools can mean the difference between success and failure. Portfolio management isn’t just about tracking prices; it’s about understanding risks, making data-driven decisions, and aligning investments with long-term goals. CoinIQ is at the forefront of this evolution, equipping investors with the intelligence needed to navigate the complexities of crypto markets effectively.

If you're serious about crypto investing, it's time to move beyond simple tracking tools and embrace smarter portfolio management with CoinIQ.